carried interest tax changes

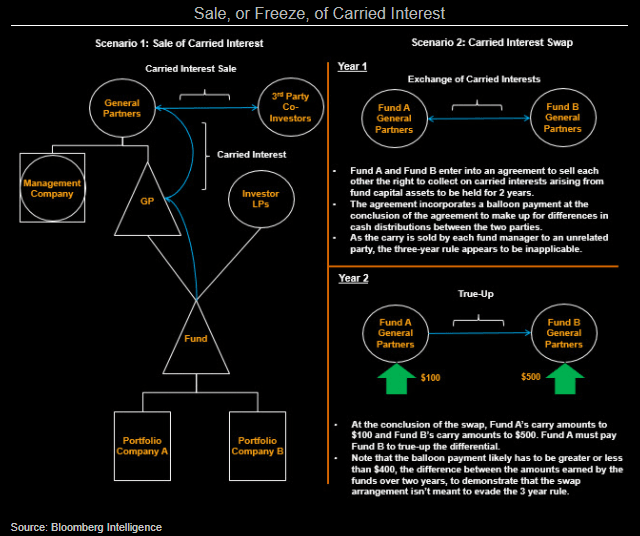

The TCJA extended the time that investment funds need to hold investments to qualify for long-term capital gainsat least three. Carried interest is taxed as capital gains.

The current tax treatment of carried interest is the result of the intersection of several parts of the Internal Revenue Code.

. Many PE funds considered converting to C corporations after TCJA lowered the corporate rate to 21 since the corporate form has other advantages including. New York Governor Andrew Cuomo announced in January that he is seeking to change the treatment of carried interest for state tax purposes and impose additional tax on hedge fund managers working in New York. The 17 tax differential.

Bush has vowed to eliminate the tax break that allows compensation to be taxed at the lower capital-gains rate yet carried interest continues. Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021 202 PM EDT Christina Wilkie. Some changes came about when the Tax Cuts and Jobs Act TCJA went into effect in 2018 so you might have to pay ordinary income tax rates on carry under some circumstances.

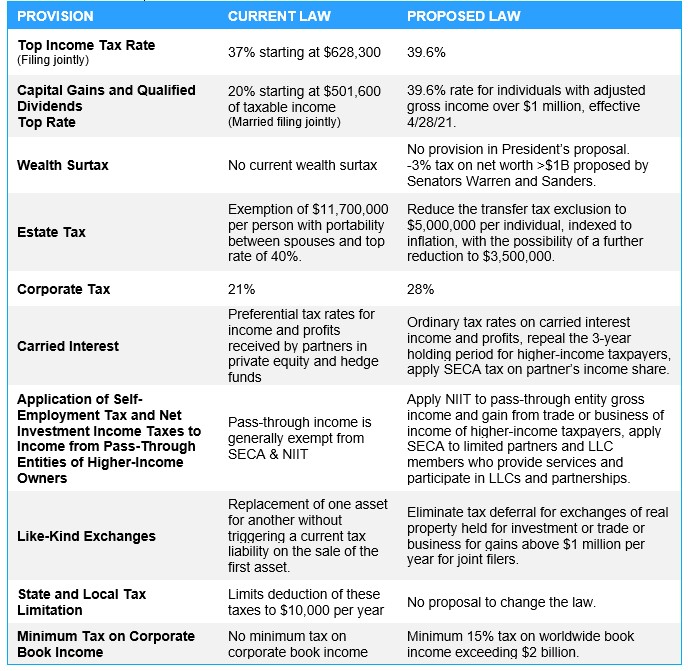

Capital Gains Tax. 115-97 extended the holding period for certain carried interests applicable partnership interests APIs to three years to be eligible for capital gain treatment. Biden also proposed raising the capital gains tax rate for households earning over 1 million a year to 396 which is the proposed top income tax rate.

A carried interest is a form of profits interest that gives a service provider the right to share in future partnership profits but is not taxable upon receipt because it. Several lawmakers have also introduced the Carried Interest Fairness Act which would tax carried interest at ordinary income tax rates and treat it as wages subject to employment taxes. According to a press release issued by the Finance Committee in conjunction with the bills introduction the proposed.

The final regulations retain the basic structure of the proposed regulations with certain changes made in response to comments. US Chamber of Commerce report predicts tax changes could see the PEVC industry shrink by nearly 20 percent A US Chamber of Commerce study predicts dire consequences if tax on carried interest is increased by 98 percent the effective outcome of carry being taxed as income Private Funds CFO reported. Under the new policy carried interest now has a.

In January 2021 the US. A report by the accounting firm KPMG on the American Jobs and Closing Tax Loopholes Act which passed the Democratic-controlled House in 2010 and applied tax treatment to carried interest similar to the Biden plan found that the bill could apply to partnerships in virtually any kind of business and could fundamentally change how partnerships are taxed. As of the second quarter of 2019 private equity and hedge funds had roughly 143.

Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be eligible for preferential long-term capital gain. Every president since George W. The law known as the Tax Cuts and Jobs Act PL.

Do I Need To Pay Income Tax on Carried Interest. Having escaped federal tax reform largely unscathed fund managers and other holders of carried interests now need to look to the states. The preferential tax rate is especially important for a private equity fund and its managers.

If the carried interest tax loophole is closed private equity and hedge fund managers might take actions that could draw SEC scrutiny. Under Bidens proposals capital gains tax would increase to a potential 434 in 2021 including a 38 tax on net investment income from 238 for those with adjusted gross income exceeding 1 million. Trillion in assets under managementan increase of nearly 40 over the past four years.

It made sense for PE firms to operate as partnerships when the corporate tax rate was 35 and there was a lower tax rate on capital gains that also applied to the fund managers carried interest. Senate Finance Committee Chairman Ron Wyden D-OR and committee member Senator Sheldon Whitehouse D-RI re-introduced legislation to change the taxation of carried interestthe Ending the Carried Interest Loophole Act. Department of Treasury and the Internal Revenue Service released final regulations the Final Regulations under Section 1061 of the Internal Revenue Code of 1986 as amended the Code.

Democrats Carried-Interest Plan Seen as Harsher Than It First Appeared Funds may have to hold assets for more than five years House. Assuming a 2x return on a 10MM fund versus a 1 Billion fund a 20 carried interest is 2MM versus 200MM respectively. Phil Jelsma To the surprise of many the new tax policy included changes to the carried interest provision.

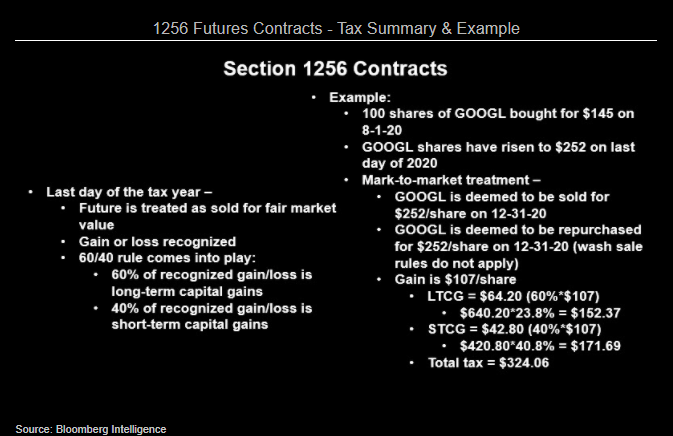

Clearly not all carried interest is the same. A private equity fund typically uses carried interest to pass through a share of its net capital gains to its general partner which in turn passes the gains on to the investment managers figure 1. This tax information and impact note deals with changes to the carried interest rules for Capital Gains.

Under Bidens proposal fund managers might change valuation. The managers pay a federal personal income tax on these gains at a rate of 238 percent 20.

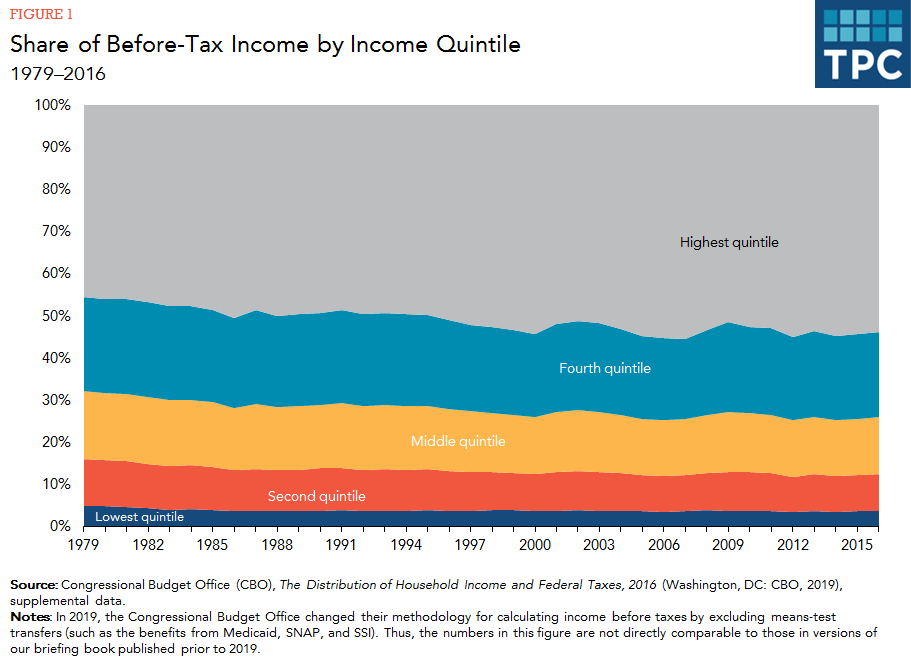

What Is The Tax Expenditure Budget Tax Policy Center

Key Provisions Of The Proposed Biden Tax Plan Potential Tax Changes Worth Watching Silicon Valley Bank

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

Doing Business In The United States Federal Tax Issues Pwc

How Do Taxes Affect Income Inequality Tax Policy Center

What Are The Consequences Of The New Us International Tax System Tax Policy Center

What To Know About The Tax Benefits Of An Opportunity Zone Bader Martin

Carried Interest Regulations And The Future Of A Debated Tax Break 2021 Articles Resources Cla Cliftonlarsonallen

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Carried Interest In Venture Capital Angellist Venture

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

What To Know About The Tax Benefits Of An Opportunity Zone Bader Martin

Lobbying Kept Carried Interest Out Of Biden S Tax Plan Bernstein Says

What Are The Consequences Of The New Us International Tax System Tax Policy Center

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)